China's Commercial Vehicles: Deepening Roots, Gaining Ground Overseas

Driven by globalization, China’s commercial vehicle industry has entered a new era of global expansion. Domestic brands are accelerating their global strategies, shifting from simply exporting vehicles to building a multidimensional presence involving global markets, localized ecosystems, and international branding. Competition is also evolving from price-based rivalry to a more comprehensive contest centered on ecosystem collaboration and deep industrial integration.

01

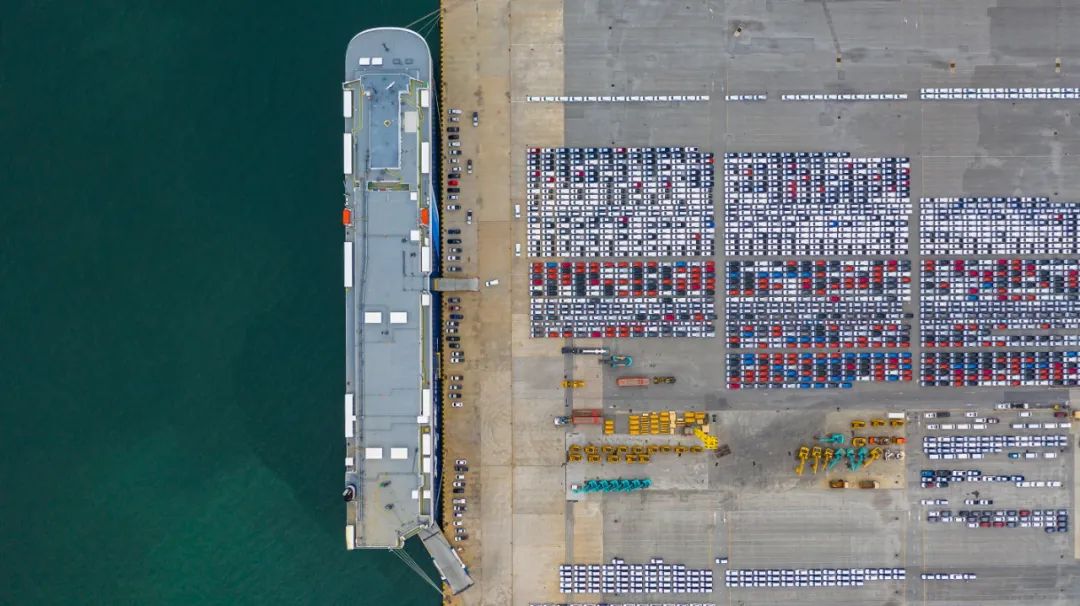

Seizing Growth in Overseas Markets

In recent years, China’s commercial vehicle exports have shown robust growth, becoming a core driver of the industry’s expansion. Data indicates that from 2021 to 2024, exports reached 402,000, 582,000, 770,000, and 914,000 units, with year-on-year growth rates of 70.7%, 44.9%, 32.2%, and 17.5%, respectively. This upward trend continued into the first quarter of 2025, with cumulative exports hitting 242,000 units—a 13.1% increase year-on-year—repeatedly setting new records.

These breakthroughs are the result of Chinese commercial vehicle manufacturers leveraging their technological strengths and supply chain systems, reflecting their sustained efforts to expand globally. Today, China’s commercial vehicle sector has established a complete supply chain covering R&D, manufacturing, and services, building a mature ecosystem that is gaining broad recognition worldwide. Moreover, as global demand for low-carbon and intelligent electric vehicles continues to rise, new opportunities are emerging for Chinese commercial vehicle brands. For example, at the 2024 Hannover Motor Show, more than 460 Chinese commercial vehicle and supply chain exhibitors showcased innovations in electrification, intelligence, connectivity, and models tailored to overseas markets. This demonstrated not only the industry’s capacity for transformation and ability to capture new markets but also underscored Chinese manufacturers’ commitment to deepening international cooperation and expanding their global footprint.

The collective global push is also a strategic response to intensified competition in the domestic market. As a representative from Sinotruk noted, “Rather than focusing on internal competition, it’s more productive to expand overseas—especially in Belt and Road countries and rapidly growing economies with active infrastructure development, such as Africa, Southeast Asia, and the Middle East.” These regions are becoming core growth drivers, offering vast potential for Chinese commercial vehicle exports.

Capitalizing on this opportunity, an increasing number of Chinese commercial vehicle companies are deepening their overseas presence. Both established manufacturers and new players are placing global markets at the heart of their strategies. Since the beginning of 2025, leading companies such as Sinotruk, FAW Jiefang, Foton, Dongfeng, Shaanxi Heavy-Duty Truck, and Yutong Bus have secured orders for hundreds or even thousands of vehicles across Asia, Southeast Asia, South America, South Africa, Europe, and the United States. New energy vehicle makers, including DeepWay, Subaru Technology, Proton Auto, and Weidu Technology, are also accelerating their overseas efforts through order signings, partnerships, and facility development—creating a multidimensional landscape where both traditional and emerging players jointly explore the global market.

02 Building Localized Ecosystems

From cautious initial forays to strategic expansion, Chinese commercial vehicle companies have grown increasingly determined to establish a global presence. Their approach has evolved from limited整车 exports to building overseas production facilities, and now to in-depth collaboration across the industrial chain to create localized ecosystems. China’s commercial vehicle exports have thus transitioned from a trade-focused model to a multidimensional strategy rooted in ecosystem development.

Take traditional industry leaders as examples. Sinotruk has adopted a “technology-driven + localized operations” model, building an integrated transnational value chain that covers R&D, manufacturing, and services. The company now operates 29 overseas KD plants, has dealerships in more than 90 countries, and maintains a parts and service network across over 110 countries, forming a comprehensive global marketing and service system.

FAW Jiefang has achieved both product and service delivery through its worldwide operations, which now span more than 80 countries and regions. Its overseas subsidiaries and KD plants enable localized production, decentralized decision-making, and resource allocation that closely aligns with regional market needs. At its “2025 Global Partner Conference+,” FAW Jiefang unveiled the “SPRINT 2030” internationalization strategy, outlining a shift from market internationalization to brand internationalization and emphasizing parallel development of domestic and international product lines.

Under its “GREEN 3030” strategy, BAIC Foton has upgraded its globalization approach to “local production + technological collaboration,” further deepening its international footprint. Yutong Bus, through localized KD assembly partnerships, has moved from exporting products to exporting technology and brand influence, strengthening its leadership in the global bus sector.

New energy commercial vehicle companies are also demonstrating strong global momentum. For instance, Subo Technology began construction of an overseas skateboard chassis smart manufacturing base at the end of March this year, with plans to operationalize it by the end of 2025. Once completed, the facility will provide localized solutions for markets including Europe and the Middle East. In June, Subo announced a “Dual-Track Empowerment” strategy: co-developing next-generation electric heavy-duty trucks with overseas partners while opening its core technology platform to empower more international automakers—creating a dual engine of technology export and ecosystem co-creation.

03 Long-Term Value Creation

Through multifaceted strategies—including international marketing, overseas production capacity, and joint ventures—Chinese commercial vehicle companies are driving a strategic shift from “product export” to “ecosystem development.” This transformation reflects a broader move away from competing on price alone toward a long-term strategy centered on value creation. By emphasizing technology empowerment, ecosystem collaboration, and localized operations, these companies are building differentiated competitive advantages in the global market.

Although China’s commercial vehicle industry has expanded rapidly internationally in recent years, it still faces multiple challenges. Cao Guangping, an independent researcher in new energy and intelligent connected vehicles, notes that domestic brands must not only pursue sales growth but also ensure their products meet the demands of export markets and achieve sustainable brand presence amid international competition. In response, many companies have established overseas production bases, R&D centers, and sales networks, gradually achieving localized production and service. These efforts help circumvent tariff barriers, reduce logistics costs, and enhance market responsiveness and product competitiveness.

Industry observers emphasize that expanding their ecosystem overseas is a crucial step for automakers—shifting from a product-centric to a brand-centric approach, which is essential for building a lasting presence in international markets. Currently, Chinese commercial vehicle brands face challenges such as limited brand premium, inadequate after-sales support, and regulatory barriers. Reliance on low-price advantages is unsustainable, especially in high-end markets like Europe and the U.S., where competition is systemic. Therefore, to evolve from a major exporter to a strong global player, companies must consolidate their comparative advantages, establish a full-value-chain overseas manufacturing system, and deepen localization in marketing, R&D, service, and brand building—while also strengthening supply chain resilience and technological leadership.

“High cost-performance is a key factor in the expansion of Chinese commercial vehicles, but it is not a long-term competitive moat,” says Kong Zhen, an associate professor at Beijing Information Vocational and Technical College. He believes Chinese manufacturers must cultivate distinct brand identities and build a reputation for high quality and value to gain a firm foothold in the international market. Notably, the industry is already shifting from pursuing “volume growth” to “quality improvement.” Rising average export prices and an increasing share of high-end models indicate that China’s commercial vehicle sector is moving up the global value chain. “Chinese commercial vehicle companies must adopt a long-term perspective toward global expansion—not only going global but also going deep and moving up, enhancing brand value through global strategic deployment and localized operations. It is with this mindset that companies can transition fromcompeting on price to competing on value,” he added.

Looking ahead, as globalization efforts deepen to encompass technology, ecosystems, and branding, the Chinese commercial vehicle industry is poised to nurture more globally competitive enterprises during this wave of international expansion. By integrating deeply into global industrial chains and optimizing the allocation of resources worldwide, China’s commercial vehicle sector is set to reshape the global industrial landscape—transitioning from a technology follower to a standard-setter.